Hidden in the recent S-3 that everyone’s favorite reverse-merger pink sheet Coronacrapper, Cytodyn (CYDY), filed after the close on the 17th of December was an interesting paragraph providing more details on a transaction the company did back in March of this year. One may remember it from way back when the shares really started to catch the eye of bored, stuck-at-home, retail investors in the USA, and, somewhat inexplicably, Germany. The press release announcing the deal appears misleading at best, knowingly false at worst, and designed to sucker retail no matter what, especially given the conversion price was stated to be far higher than the market price at the time.

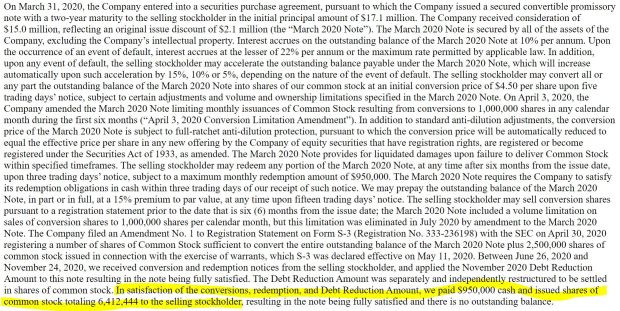

The deluded investors buying the shares would guess, given the scant details in the press release, that the note would be convertible into 3.333mm shares ($15mm/$4.50). The only true statements appear to be that Cytodyn completed a financing, someone invested, and there were no warrants attached. Everything else turned out to be untrue. All the details can be gleaned from this paragraph from the recent S-3:

The actual amount of the note was $17.1mm, not $15mm. The company receivied $15mm, but owe the investor $17.1mm.

The unnamed “institutional investor” was actually a financier named John M. Fife.

And to pay the supposed “15mm non-dilutive no warrants” note off, the company paid $950,000 in cash, and issued 6,412,444 shares. Shares which at today’s pumped up share price is worth at least $33mm and seems far from non-dilutive.

Based on the press release, an investor buying the stock would have believed that the note was convertible into only 3.33mm shares ($15mm/$4.50 stated strike). Instead the true effective conversion number was 3.8mm shares ($17.1mm face/$4.50), which makes the effective conversion price at time of issuance $3.95 per share ($15mm paid for the note/3.8mm true conversion amount).

The true effective conversion price, based on last Friday’s revelation, is actually $2.19 ($15.0mm paid for note – $0.95mm cash payment)/6.412mm shares issued)

So what exactly happened between issuance with hype filled press releases in March and payoff, revealed in a little paragraph snuck into an S-3 filing, last Friday? Simple: Investors just got a taste of the FULL RATCHET.

5 comments